Enhance your expertise. Advance your career.

Delivered by the Institute for Financial Integrity (IFI) in partnership with American University of Iraq – Baghdad (AUIB) and the Central Bank of Iraq, the Fundamentals of Financial Crime Compliance training program is designed to help protect the financial integrity of the Iraqi and global financial system by facilitating and demonstrating effective implementation of global AML/CFT standards, and promoting a culture of financial crime compliance and risk management throughout the Iraqi financial system.

Enhance your expertise. Advance your career.

Delivered by the Institute for Financial Integrity (IFI) in partnership with American University of Iraq – Baghdad (AUIB) and the Central Bank of Iraq, the Fundamentals of Financial Crime Compliance training program is designed to help protect the financial integrity of the Iraqi and global financial system by facilitating and demonstrating effective implementation of global AML/CFT standards, and promoting a culture of financial crime compliance and risk management throughout the Iraqi financial system.

The Experience

Online Self-Study

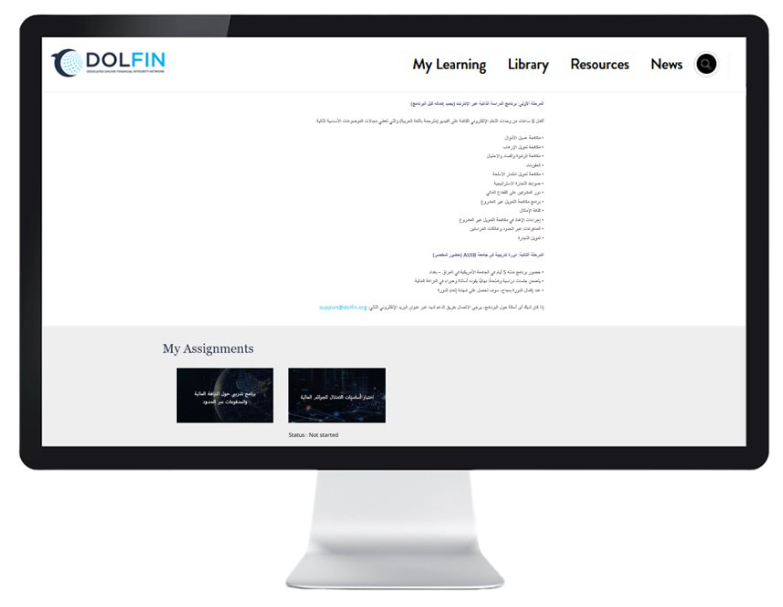

Study at your own pace from a curriculum developed by renowned experts who designed the modern global counter-illicit finance regime. The online experience is powered by the Dedicated Online Financial Integrity Network—or DOLFIN®—a learning platform for global financial integrity professionals dedicated to safeguarding the financial system from illicit use and combating threats to our collective security.

On-Campus Instruction

Learn from some of the world’s leading financial integrity experts who will conduct in-person classroom sessions on the AUIB campus covering a range of counter-illicit finance topics with emphasis on anti-money laundering (AML), countering the financing of terrorism (CFT), and establishing a culture of compliance.

Examination

Sit for the proctored open-book exam delivered online via the DOLFIN® platform. Upon successful completion of the program, participants will receive a certificate of completion.

Online Self-Study Program (Pre-Work)

Prior to attending the AUIB Residential Program, participants will have one week to complete 8 hours of video-based eLearning modules (subtitled in Arabic) covering the following core topic areas:

-

Anti-Money Laundering

-

Countering the Financing of Terrorism

-

Anti-Bribery, Corruption, and Fraud

-

Sanctions

-

Countering the Financing of Proliferation

-

Strategic Trade Controls

-

The Role of Financial Sector Supervisors

-

Counter-Illicit Finance Programs

-

Culture of Compliance

-

Enforcement Actions in Counter-Illicit Finance

-

Cross-Border Payments and Correspondent Relationships

-

Trade Finance

AUIB Residential Program

-

Attend the 5-day on-campus program with the American University of Iraq – Baghdad

-

Includes classroom sessions and a final exam led by professors and industry experts

-

Upon successful completion, you will receive a certificate of completion

.jpg?width=2000&height=1333&name=32%20(11).jpg)

Day 1

-

Introductions and Course Overview

-

Financial Integrity Mission, Stakeholders, & Standards

-

Illicit Finance Threats, Vulnerabilities, and Risks

-

Money Laundering & Terrorist Financing

-

Money Laundering & TF Exercise

-

The FCRM Analytic Framework

Day 2

-

Day Overview

-

Culture of Compliance

-

KYC, CDD, and Beneficial Ownership

-

Customer Risk Profile & Ongoing Monitoring

-

Due Diligence (Onboarding and Ongoing) Scenario Exercises

-

Introduction to Global Sanctions

Day 3

-

Day Overview

-

Sanctions Enforcement and Effective Compliance Programs

-

Sanctions Scenario Exercise

-

Foundations of Anti-Bribery & Corruption

-

Foundations of Anti-Fraud

-

Corruption Scenario Exercise

Day 4

-

Day Overview

-

Global Standards & Expectations Governing Correspondent Banking

-

Global Standards & Expectations Governing Cross-Border Payments

-

Correspondent Banking Risk Management and Cross-Border Payment Scenario Exercise

-

Foundations of Strategic Trade Controls

Day 5

-

Day Overview

-

Interactive Risk Assessment Exercise

-

Course Wrap-Up and Review

-

Examination